An Unbiased View of Florida Condominium Insurance

How Condominium Insurance can Save You Time, Stress, and Money.

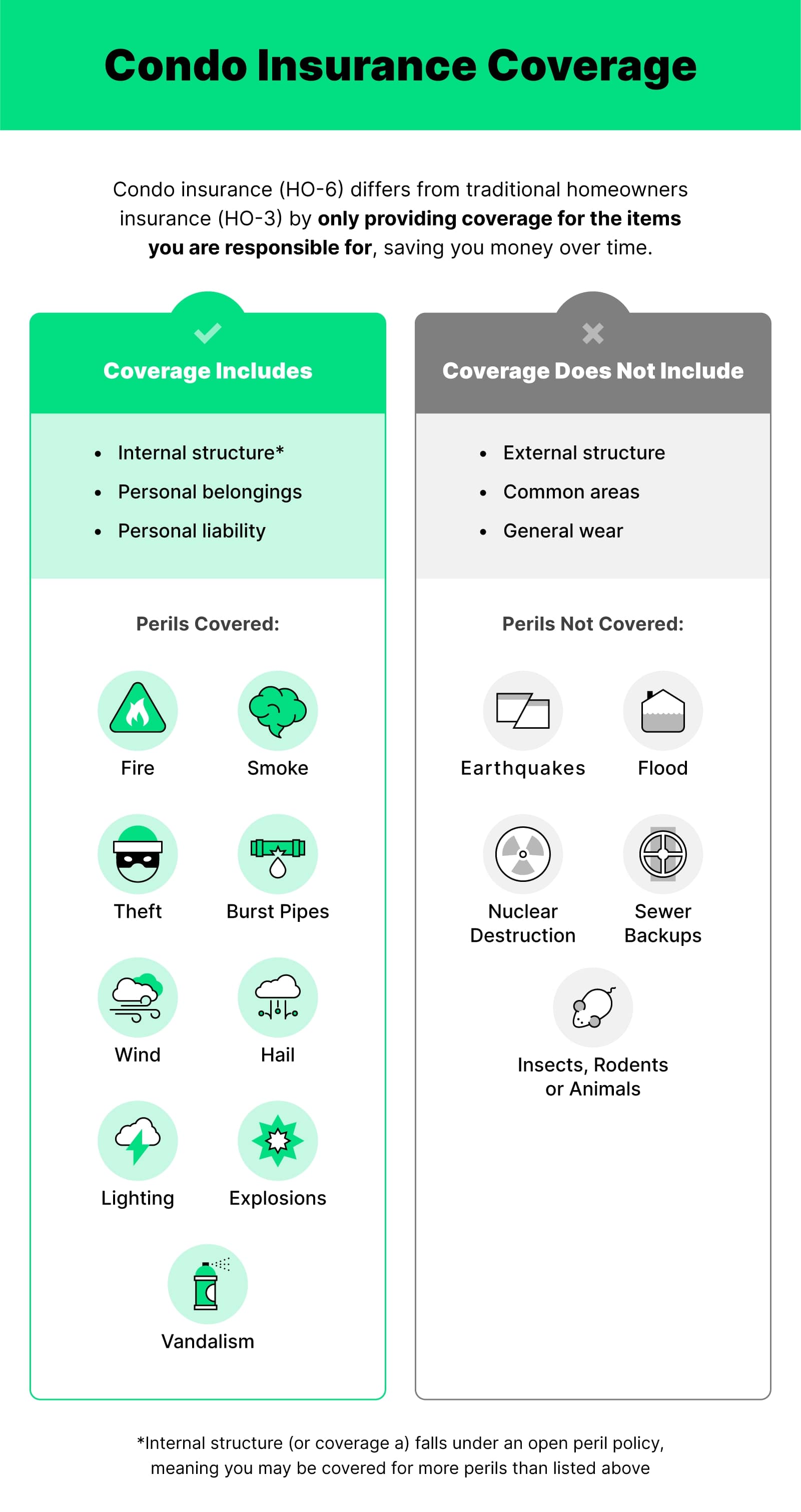

Condominium insurance is an insurance coverage policy acquired by the condominium owner that helps cover expenses related to home damage to the unit or loss of personal valuables. Believe of it as homeowners insurance for an apartment. Nevertheless, make certain you also comprehend what is covered under your house owner's association (HOA) policy, in some cases referred to as a Master Condo Policy, prior to selecting your protection.

Protecting your home Add a layer of security for your personal effects in case of fire, theft and other circumstances of destruction. Safeguarding you from liability claims PEMCO can help offer you assurance and protection if you're found lawfully liable for injury or damage at your condominium.

Definition Property owners' insurance is a particular kind of property insurance coverage. House owners' insurance coverage covers damage or loss by theft and versus dangers which can include fire, and storm damage. It likewise may insure the owner for accidental injury or death for which the owner might be legally responsible. Mortgage lenders generally require homeowners' insurance coverage as part of the home mortgage terms.

Condominium Insurance - SEFCU Insurance

Top Guidelines Of Home Insurance - Condominium Insurance - USI Affinity

Property Owners' Insurance Plan There are multiple types of house owners' insurance policies. HO-1 Fundamental Type HO-1 policies are one of the most basic type of homeowners' insurance coverage. HO-1 is a called hazard strategy, so anything that takes place outside of the perils particularly called in the policy is not covered. Did you see this? of property owners' insurance coverage just covers 10 hazards: fire or smoke, explosions, lightning, hail and windstorms, theft, vandalism, damage from automobiles, damage from airplane, riots and civil turmoil, and volcanic eruption.

HO-2 Broad Kind HO-2 policies are a broad kind of house insurance. Similar to HO-1 policies, this type of house insurance just covers hazards called in the policy. Aside from covering the house's structure, HO-2 normally covers individual belongings, and some policies supply coverage for individual liability. The broad type of homeowners' insurance covers all of the dangers named in HO-1.

Condominium Insurance: Who is Responsible for What? - Wren Insurance Insurance Agency in Florida

HO-3 Unique Type HO-3 policies are an unique type of house insurance. HO-3 is an open-peril policy, rather than a named-peril policy like HO-1 and HO-2. That indicates unless the insurance provider omits a hazard from the policy, then the policy covers any type of danger, named or not. Normally, an HO-3 policy will cover the home's structure, in addition to any structures that are connected, like a carport or garage.